Trading Notes

| 5 minutes

For anyone reading this, this is all paper trading.

09NOV23

- bought /MBT just one…

- I’m going to come up with the average margin for each on my list

08NOV23

- closed /MCL at a huge loss, really didn’t expect that one -$8K

- closed /MGC with maginal profit

27OCT23

- sold /HG[Z23] (shorted) This should have been MHG, but I’m going to keep it.

- Current holdings /HG[Z23] -6, /MCL[Z23] +10, /MGC[Z23] -4, EUR/USD -50K, USD/JPY +110K

25OCT23

- closed /HGX23 at a profit

- /MCL is not doing well, it should be going up, I still have 21 days

20OCT23

- sold MGCZ23 i.e. shorted

28SEP23

- Shorted EUR/USD FOREX today, $1054

25SEP23

- Bought 10 contracts of /MCL $7040

- /HGZ23 and USD/JPY are both UP!

19SEP23

- Last night expanded my exposure on USD/JPY to +110,000. YEN 100% going up, we will see. margin: $4078

- sold EUR/USD and GBP/USD

- This morning, /HGZ23 big shift 75% down, 2 contracts, margin: $5500

12SEP23

- sold /ESU23, this did not pan out, will only do micro contracts from now on

- sold /MCLV23, this was a winner

- overall down $5K since the beginning (started with $100K) THIS IS PAPER TRADING

- only remaining postions are FOREX which don’t expire, EUR/USD, GBP/USD, USD/JPY, low risk

24AUG

- sold my /ZNU23 because it was 6 days to expiration. This did very well.

- going to buy another /ZN, bought 4 contracts

- /ES bought on 07AUG has not been going the right way, but still in it. expires in 22 days, margin is too high

- /MCL bought 4 contracts 10AUG, not following the trend

- The advantage of forex is there’s no expiration, but it’s pretty flat.

- Currently USD/JPY, EUR/USD/ GBP/USD, /MCLV23 4 contracts, /ESU23 - Very expensive, look for micro next time, /ZNU23 4 contracts

17JUL

- I have been holding everything from 07JUL until today.

- closed /MBT ($56.00)

- I’m going to start looking at both the trend and the confidence factor. As long as cf stays the same and the trend does not change, I’ll invest at 60%

- I sold /MBT because it trended down and cf was 60%

- I bought one short Copper /HG, because it was trending down and the confidence factor was 60%

- /ZB has not been following the trend correctly at all. Still staying short. Alex’s email from today explains why he thinks so. (Yellen going to China)

- Currently in USD/JPY, EUR/USD, GBP/USD, /ZN, /ZB, /HG

07JUL

- Closed /6JU23, /6EN23, /6BN23, all 10 days to expiration, not going to trade these anymore, the margin is higher than the forex

- Closed /MGCQ23, factor dropped to 50%

- Closed /MCLQ23, factor dropped to 67%

- /BZ is just too expensive ($6380) eventhough conifdence factor at 83%

- Bought /ZB, margin was $4620 - need to bump up other investments to spread this margin…I think.

- Currently in USD/JPY, EUR/USD, GBP/USD, /ZN, /ZB, /MBT

- Since 26JUN, up $2500 on $15K of margins

30JUN

- No changes today, /6J is not trending the right way, the rest have. Would be in the green without this one.

- Good Explanation of forex vs futures https://www.benzinga.com/money/forex-vs-futures

- I’ll stick with the forex for now - lower margins

29JUN

- No changes today, but did verify that USD/JPY, GBP/USD, and EUR/USD are correct

- Still need to find out about the EUREX DX and German Bund(EBL)

28JUN Only trading instruments that have an 80% or greater “confidence” factor.

- I need to learn how FOREX works in TDAmeritrade

- Margin between currency Dollar Spots and currency futures is significant

USD/JPY vs /6J

GBP/USD vs /6B

EUR/USD vs /6E- Find Out how to trade EUREX

- Bought the Forex’s to compare the spots to futures and the FOREX are reflected directly in this report.

27JUN23

- sold /BZQ23, was going to expire in 3 days!

- no micros on /BZ so not going to buy these for now…too expensive

- /ZN 75% negative, so bought a short

- /ZNU23 $2310 SEP23

- Web Version of TDAmeritrade is working well.

26JUN23

- Started a fresh paper trade with TDAmeritrade

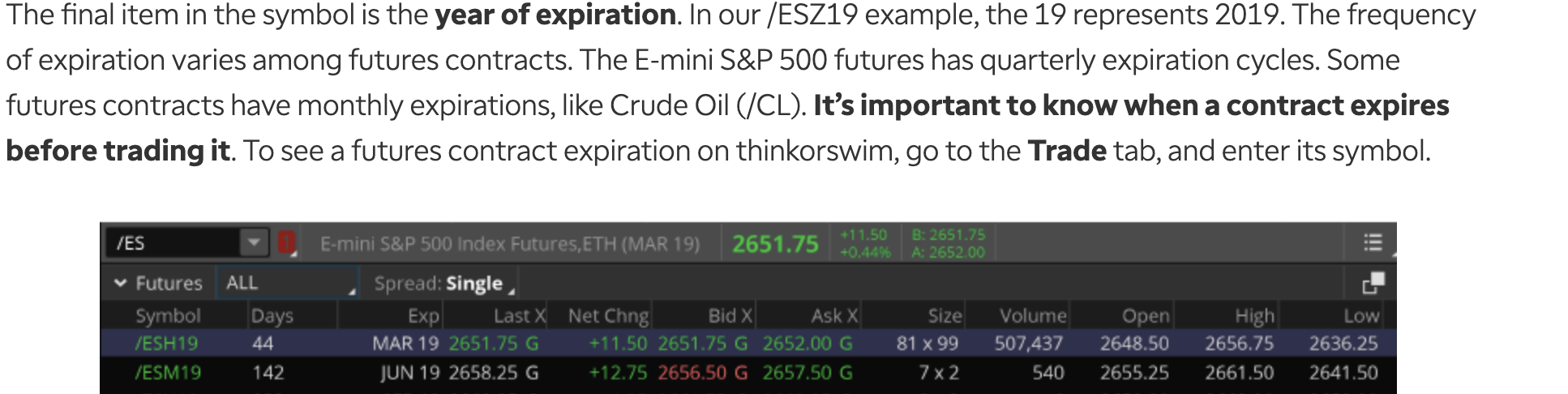

- This time I will pay attention to expiration dates.

Buying one contract of each to see the weighting and cost of each.

- Symbol Margin Expiration

- /6BN23 $2750 JUL23

- /6EN23 $2640 JUL23

- /6JN23 $3630 JUL23

- /BZQ23 $7975 AUG23

- /MBTN23 $836 JUL23

- /MCLQ23 $638 AUG23

- /MGCQ23 $913 AUG23

19JUN

- https://www.cmegroup.com/education/courses.html

- https://www.tdameritrade.com/futures/products-to-trade.html at tdamerica

17JUN23

- I learned a very important step by papertrading. Sell your contracts before they expire or expect very bad things to happen!

Month Code

January F

February G

March H

April J

May K

June M

July N

August Q

September U

October V

November X

December Z9JUN23

- /GC back to 75% Long, so bought one contract…start using the /MGC instead

- /CL backto to 75% Short, so bought one contract…no micro I can see

- Bitcoin is tempting but only at 60% Short so I’m staying out, for now 75% is the threshold I’m going to use

- Added more USD/JPY and GBP/USD because my positions were way too small

Still want to find out Alex’s naming convention vs the symbols I’m using.

Alex vs Mine

JPY/USD vs USD/JPY

USD/GBP vs GBP/USD

USD/EUR vs /6E or EUR/USDQuestions:

How long of a contract? Not all positions are available on TDAmerica? is that true for fidelity as well?

You mention in the book about trading out of an expiring contract, when? specifically, 10 days prior or more? If you are staying with the same trend, wouldn’t a long contract be more profitable?

Now to calculate the cost of each type contract…

CURRENT EXPOSURE: shows net long or net short exposure in terms of the number of strategies that are long or short and in terms of percentage of the total. For instance, if your maximum trading position limit in RBOB Gasoline were 10 contracts and your suggested exposure was -70%, you’d be short 7 contracts.

What is BP Effect?

Notes: Keep track of the expiration date for each contract.

8JUN23

- Sold /CL and /GC, both had dropped to 67% (+ and -)

- Bought more /SIL, increased to +92%

/6E +5 $14575

/BZ -1 $6380

/ES +1 $12320

/HG -2 $14300

/MYM +1 $880 (just playing here)

/SIl +4 $8360 (increased by 2 today)

$56815Vanguard funds VFIAX